If you own property you should have recently received your 2019 real property Reassessment Notice, likely notifying you of an increase in your market value, assessed value and estimated taxes for 2019.

If you own property you should have recently received your 2019 real property Reassessment Notice, likely notifying you of an increase in your market value, assessed value and estimated taxes for 2019.

In a recent press release, the County Assessor's Office advised that across the County, residential properties increased in value by approximately 18% exclusive of new construction. 84% of the single family residences increased from their 2018 value. Of the single family residential properties that saw an increase, 54% increased by 15% or less, while 16% saw no increase or a decrease from 2018. No statistics are provided for commercial properties, but similar or higher increases are being reported.

Per the County, your Reassessment Notice reflects the market value and assessed value of the subject parcel as of January 1, 2019 and shows the change in that valuation from the 2018 valuation. The Notice also includes estimated non-binding tax levies (rates) provided by applicable taxing jurisdictions (city, school district, fire district, library district, county, etc.), not the assessor. The projected tax calculation that accompanies the Notice is calculated by using those estimated tax levies and the assessed value reflected in the Notice.

"It is important to understand that even if your property value increases, that does not mean your tax bill will increase proportionately," Jackson County's Director of Assessment, Gail McCann Beatty said. "It may not increase at all."

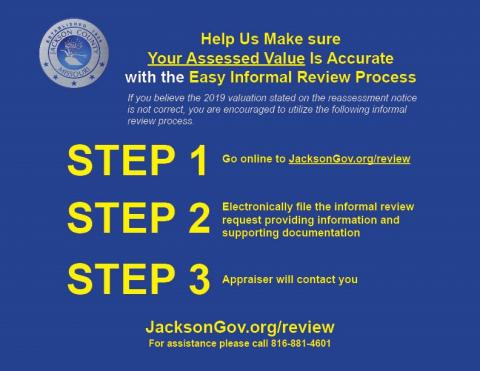

If you disagree with the valuation reflected on your notice, you'll need to act quickly to request an informal review of that valuation by filing online at www.jacksongov.org/review or by calling the Assessment Department at (816) 881-4601. The deadline to file an informal review request is Monday, June 24, 2019.

View the full press release at www.jacksongov.org. Or for more information about property assessments, including FAQs visit www.jacksongov.org/Assessment.